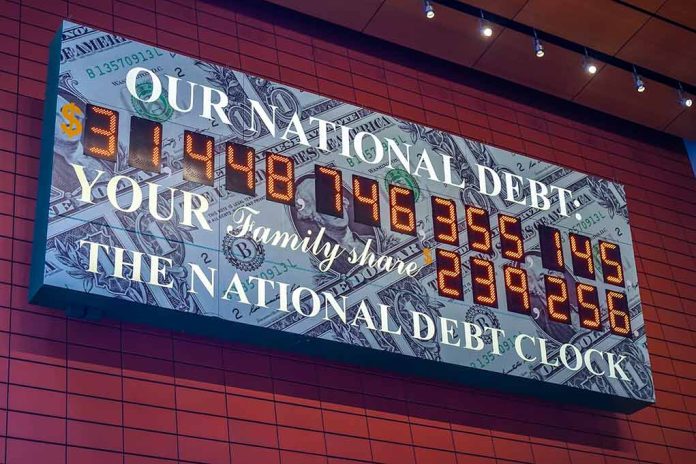

America faces a looming debt ceiling crisis that could trigger a catastrophic default on its $36 trillion debt as early as July, threatening economic stability and requiring immediate congressional action.

Key Takeaways

- The U.S. could default on its national debt between July and October 2025 without congressional intervention, according to the Bipartisan Policy Center.

- House Republicans are preparing a $4 trillion debt ceiling increase bill that includes border security measures, energy regulation changes, and tax cuts.

- Multiple factors affect the timeline: tax revenues, disaster relief spending, tariff income, and overall economic performance.

- Treasury Secretary Scott Bessent has extended borrowing capacity until June 27 through extraordinary measures including tapping federal employee pension funds.

- Failure to address the debt ceiling could result in market volatility, higher borrowing costs, and damaged confidence in U.S. fiscal stability.

Understanding the Debt Ceiling Timeline

The U.S. debt ceiling, which limits how much the government can borrow to meet its financial obligations, is projected to be reached between July and October 2025. This forecast comes from the Bipartisan Policy Center, which has analyzed data from the Treasury Department and Congressional Budget Office. The current suspension of the debt ceiling expired on January 2, 2025, following a bipartisan agreement reached in 2023 between former President Biden and then-House Speaker McCarthy that included scaling back COVID-19 relief programs and strengthening work requirements for SNAP benefits.

Treasury Secretary Scott Bessent has already implemented “extraordinary measures” to extend the government’s borrowing capacity until June 27, including tapping into federal employee pension funds. If Congress fails to address the debt ceiling by the so-called “X Date,” the government would be unable to pay its bills, potentially triggering a first-ever default on U.S. debt obligations.

The US could breach the debt ceiling sometime between mid-July and October if Congress does not act, according to the Bipartisan Policy Center https://t.co/fdQrZ9QVOm

— Bloomberg Economics (@economics) March 24, 2025

Congressional Battle Lines

House Republicans are preparing legislation to increase the debt limit by $4 trillion over two years. This proposal combines the debt ceiling increase with border security enhancements, energy regulation changes, and a $4.5 trillion tax cut package. House Speaker Mike Johnson and Republican leadership have advocated for a comprehensive approach, bundling these priorities together in a single piece of legislation.

“The House is determined to send the president one big, beautiful bill that secures our border, keeps taxes low for families and job creators, grows our economy, restores American energy dominance, brings back peace through strength, and makes government more efficient and more accountable to the American people,” wrote Republicans in a statement.

Senate Majority Leader John Thune has countered with a two-bill strategy that would separate immigration and energy initiatives from tax cuts. This approach reflects the challenging reality of navigating a politically divided government. Additionally, fiscal hawks within the GOP may oppose increases to the government’s borrowing authority altogether, further complicating efforts to reach consensus. Democrats, who traditionally favor suspending the debt ceiling rather than raising it, will likely oppose a party-line Republican bill.

Economic Implications and Warning Signs

The potential economic consequences of failing to address the debt ceiling are severe. Financial experts warn that even approaching the “X Date” without a clear solution could trigger market volatility, increase borrowing costs for both the government and ordinary Americans, and undermine confidence in U.S. fiscal stability. These factors could ripple through the economy, affecting everything from mortgage rates to retirement accounts.

Multiple factors influence the exact timing of when the debt ceiling will be reached, including tax revenue collections, hurricane season impacts and related disaster relief spending, tariff revenues, and the overall strength of the U.S. economy. Additionally, spending cuts implemented by the Department of Government Efficiency (DOGE) could affect the timeline. The complex interplay of these variables creates uncertainty about the precise date when the Treasury will exhaust its ability to pay the nation’s bills, making early congressional action all the more critical.

Legislative Pathways Forward

Congress faces several potential legislative paths to address the debt ceiling. The reconciliation process, which bypasses the Senate filibuster by requiring only a simple majority vote, has been considered. However, this approach requires both houses to pass an identical budget resolution, and significant differences exist between the House and Senate blueprints. The House proposal includes a $4 trillion debt ceiling increase over two years, while the Senate version doesn’t address the debt limit at all.

Another option under consideration involves attaching a debt limit increase to disaster relief funding legislation. This strategy could potentially garner broader support by linking the debt ceiling to urgent disaster response needs. Regardless of the specific legislative vehicle chosen, policy experts emphasize that early action is essential to avoid economic disruption. Previous debt ceiling standoffs have demonstrated that even the perception of potential default can have negative consequences for financial markets and the broader economy.