A Surprising Convergence in Policy

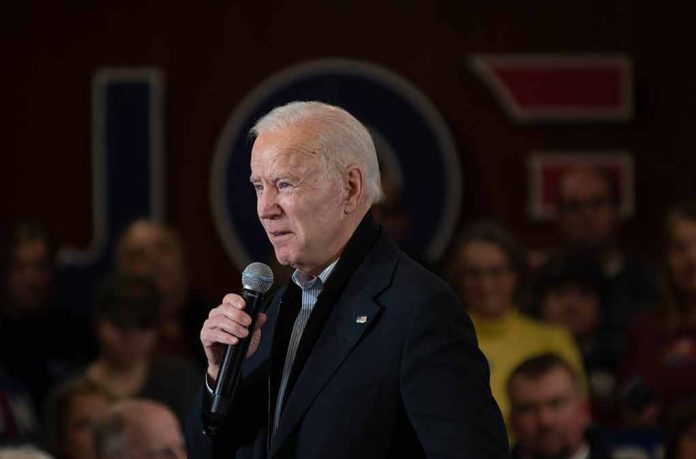

In a striking instance of bipartisanship, President Joe Biden has announced his support for an initiative first suggested by former President Donald Trump to eliminate federal income taxes on tips. This initiative, aimed at providing greater financial stability to service industry workers, is also promoted by Vice President Kamala Harris.

Potential Impact on Workers and Policy Details

Eliminating taxes on tips would, on the surface, seem to benefit millions of service and hospitality workers by allowing them to keep their entire earnings. About four million people worked in tipped occupations in 2023, with many earning too little to owe federal income taxes.

However, it’s essential to note that this proposal may not significantly impact many tipped workers. Approximately 37% of tipped workers did not owe federal income taxes in 2022.

Challenges and Legislative Hurdles

While the removal of federal income taxes on tips seems straightforward, the policy faces several challenges. The detailed proposals from Trump and Harris have not yet been released and would ultimately require Congressional approval. Harris’s plan also includes provisions for raising the minimum wage and setting an income threshold to prevent misuse, but tips would still be subject to payroll taxes.

Furthermore, the policy’s impact on federal revenue and the budget deficit is a significant concern. Estimates suggest that removing federal taxes on tips could increase the federal budget deficit by $107 billion to $250 billion over ten years. As such, Congressional lawmakers might be hesitant to add to the complexity of the existing tax code.

Additionally, criticism surrounds these proposals due to their potentially politically motivated nature. The initiatives may only minimally benefit the lowest-earning tipped workers, while contributing to higher deficits.

Support from Key Lawmakers and Unions

Notably, Senator Ted Cruz has also introduced the “No Tax on Tips Act,” which seeks to allow deductions of tips from federal income taxes but not payroll taxes. This legislation enjoys bipartisan support from Nevada Senators Jacky Rosen and Catherine Cortez Masto, alongside backing from the Culinary Workers Union Local 226.

White House Confirmation and Political Ramifications

White House Press Secretary Karine Jean-Pierre has confirmed President Biden’s support for this initiative, but the timing of this endorsement has raised questions. Reporters have probed why Biden and Harris did not pursue this policy earlier in their term. Jean-Pierre emphasized their focus on historic legislation benefiting middle-class workers and communities typically left behind.

Jean-Pierre reiterated that the Biden-Harris administration is committed to raising the minimum wage and eliminating federal income taxes on tips to support our hardworking service workers, pointing to recent efforts to promote middle-class economic well-being.

Criticism and Public Reactions

Critics, including some within the Republican Party, have echoed Trump’s accusations that Harris is merely adopting his policy idea to gain political favor but will not follow through with the necessary actions. Trump himself has predicted that Harris will not keep her promises related to this proposal.

Conversely, experts have voiced concerns over the broader economic implications, suggesting that while the elimination of these taxes could potentially aid higher-income workers more than low-wage earners, the policy adds undue complexity and costliness to the tax code.

In sum, while the notion of eliminating federal income taxes on tips appears commendable, its practicality and actual benefit to many low-income workers remain in question. As Congress considers this policy, its feasibility, cost, and broader economic impact must be carefully weighed.

Sources

1. Biden supports cutting taxes on tips, White House says